Updated Feb 2023

You’ve seen the videos- become a millionaire before you’re 30 with your Airbnb empire. Before you sign on the dotted line, make sure you become familiar with the requirements and responsibility of renting via Airbnb, Vrbo, Home Away or other temporary housing apps.

Note to those who already took the plunge and already operate an Airbnb or short-term rental in the Philadelphia area- these new rules apply to you too. You will need to update your details and secure the proper zoning and license along with the newbies.

Ch-Ch-Changes

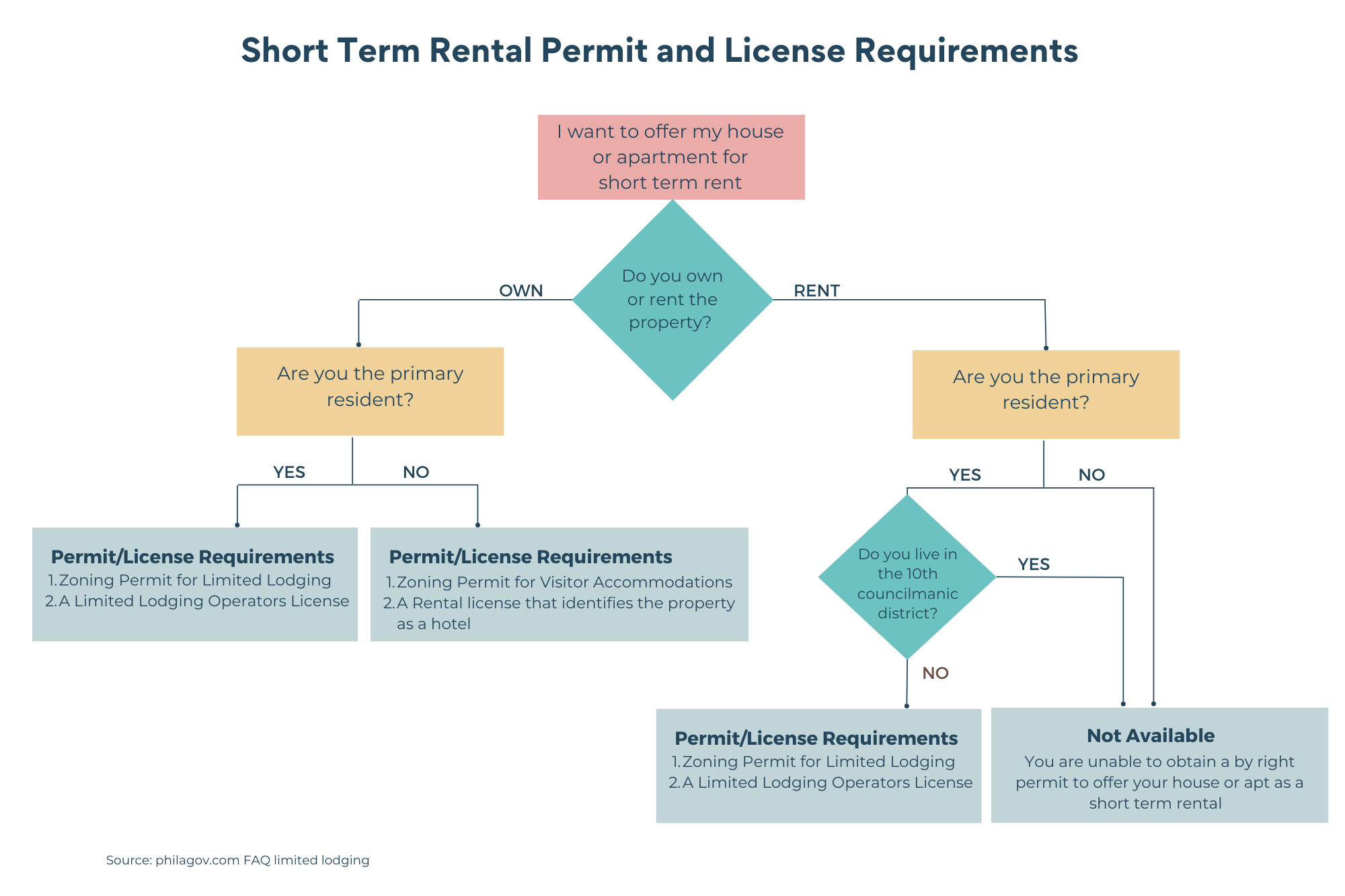

New Philadelphia laws for renting your property via an app have passed and went into effect on April 1, 2023. These requirements apply to renting your entire property or a room in your home for less than 30 days, often called Short Term Rentals or Temporary Rentals. Some rules previously existed and others are entirely new as of when the new law was written in 2022. The bottom line is you need the correct zoning, permits and licenses in order to rent a property or room for less than 30 days.

You’ll need:

To determine which Zoning Permit is for you

To determine which License is for you

Obtain a Commercial Activity License

Obtain a Philadelphia Tax ID

Get Into the Zone

Before you apply for a license to legally rent your property or a room in your home, you must first obtain your zoning permit. You can apply for either permit through the eCLIPSE website.

If you are a primary resident (renter or owner) you will need a Limited Lodging Permit. Your home must be zoned as a residential dwelling. Which it most likely is if you are already living in it!

If you are not a primary resident you will need a Visitor Accommodation Permit. Note, the Zoning Code does not permit the Visitor Accommodations everywhere in the city. This means you will have to secure a zoning variance. More on that below.

Find your team

Zoning permits are one of the trickiest parts of this process. Many residential homes do not allow “use by rights” Visitor Accommodations zoning that is needed if you do not occupy the property you are renting out. Therefore you have to go through the very challenging process of obtaining a variance, and we should warn you now, you may not be granted in the end. Here is our bottom line advice: don’t do it alone.

You’re going to need a team to help you navigate applications, zoning hearings, neighborhood associations, hiring a zoning attorney etc. Our clients who run a successful Airbnb hired an architect to manage the process “ yes, we had the additional cost of having our architect manage everything, but we also knew that it would be done right. Now we operate our Airbnb legally and without worry”.

Another route is to tap into the experts at Philly Permit. They know the ins and outs of all things to do with well… Philly and permits! They will hold your hand throughout the grueling process and can introduce you to a zoning attorney if you need. Again, this comes with an additional fee ranging from $700-$1200+ depending on which permit you're applying for and the size and particulars involved with your specific property. Think of it as the cost of doing business. You can make that back easy with your legal and successful Airbnb once it’s up and running. It’s 100% worth it!

If you need to be convinced further that you’ll need some major assistance in this step, dive into the complicated web of the city’s zoning website and tools provided. Use the zoning generator to discover what is allowed via your property zoning. If Visitor Accommodations is listed under the “use by rights” section you are golden and securing that permit will be much easier. Otherwise, see above.

Take your Pick

There are two different licenses for two different scenarios when it comes to temporary rentals. Pick which meets your criteria. No matter the choice, “temporary rental” is defined as “renting a room or your entire home for less than 30 days”. If you are looking for long-term rentals, check out our Steps to Becoming a Landlord blog.

Primary Residence

If you are a primary resident at your property you obtained the Limited Lodging Permit. You will also need the Limited Lodging Operator License to move forward.

What’s Needed

Your brand new Limited Lodging Permit

Pay a $150 fee for the Limited Lodging Operator License each year that you operate.

If you recently purchased the property, you may have to submit proof of the deed.

If you own with friends or as a company you’ll provide the owner information that has more than 49% ownership interest or the two individuals with the largest interest.

You will need proof that lead safety certification has been met, and smoke and carbon monoxide detectors are in place.

If you rent the property, you must submit a copy of your lease with written permission to temporarily rent the property to others.

If the property is located within the 10th Councilmanic District, you must own your property.

For properties over 5 bedrooms you will need to procure a Certificate of Occupancy, which inspects that the property is safe to inhabit. And yes, that comes with its own set of fees.

The Details

You can only use a licensed limited lodging and hotels booking agent to advertise your unit. They must be registered with Licenses and Inspections. In Philadelphia, Airbnb is registered with L&I.

Clearly display your license number in any advertisements for the unit.

No lodging signage can be added to your home.

Can’t alter your home to resemble anything other than a residential property.

The home can’t be occupied by more than three people (including the owner and renters) who aren’t related by blood, marriage, life partnership, adoption, or foster-child status.

Renters are only allowed to have guests between the hours of 8 a.m. and midnight.

You must tell renters the trash and recycling collection days and any trash disposal rules and regulations. You must provide proper trash containers for renters.

Excessive noise is prohibited and violators are subject to fines and penalties.

The owner or their designee must provide contact information to the renters. The contact person must handle any complaints from the renters.

Record Keeping

You must assure that the home remained your primary residence for the year.

Have the dates the home was rented.

Keep track of the number of renters.

Apply online here for the above license. You can even schedule an appointment where they will virtually help you fill out the application. If you prefer to apply in person you will need to schedule an appointment.

Non-Primary Residents

If you don’t live at your property you obtained the Visitor Accommodation Permit. You will also need a Rental License to move forward.

What’s Needed

Your brand new Visitor Accommodation Permit

Most of the documents and safety measures listed above for primary residents.

Additionally you’ll need to acquire a Rental License. That comes with a charge of $56 per rental unit, renewed each year.

No matter the size, you’ll need a Certificate of Occupancy.

What’s Allowed

This option may not be available to all neighborhoods.

This rental license must specify hotel use.

Visitor Accommodations License may either list their own properties for temporary rent or they can use a licensed booking agent.

Show Me the Money.. Said Philadelphia

The city is looking for their share of the profits. Taxes! Here is what you need in order to keep the fines away.

If you rent your property through a booking agent who collects and remits the tax on your behalf, you don’t need to file or pay the Hotel Tax yourself. If you are using the Airbnb app for example, they apply the fees to the booking and pay the city directly. More information can be found here.

If not using an app, in order to pay the proper taxes you will need to register with the city and receive your Tax ID number. If you have previously paid City Taxes (ie. you are a Philly resident) you already should have your Tax ID number. Otherwise you can find more information as well as the form at the Philadelphia Department of Revenue.

You will need to apply for a Commercial Activities License

No matter which zoning and license you obtained above, you will ALSO need a Commercial Activities License. This allows you to conduct the business of renting out your home or rooms in the city of Philadelphia.

What you need

Federal Employee Identification Number (EIN) or Social Security number

Business Income & Receipts Tax (BIRT)

You must be up to date on all city taxes

You need to provide the names of those involved in ownership of your property

More detailed information including where and how to apply can be found here.

It’s can be a bit of a bear to get the proper documents in order, but know that once you make it through, you can have a thriving short term rental property. We are happy to help you find your next investment property, let’s start by finding one that has the zoning to make the building of your empire easier. Give us a call!